Mastering the Partner Content Lifecycle

Unifyr

At the heart of effective channel enablement lies a critical yet frequently mismanaged process: the content lifecycle. This journey—from creation through distribution to performance measurement and content retirement—forms the connective tissue of partner enablement strategies. When functioning properly, it empowers partners with the knowledge, tools, and messaging they need to effectively represent supplier offerings. When broken, it becomes an expensive exercise in digital asset production with minimal return on investment.

The strategic value of content in channel partnerships cannot be overstated. While direct sales teams benefit from consistent training, messaging, and feedback loops, channel partners must simultaneously represent multiple vendors—each with distinct product lines, value propositions, and competitive positioning. Without a systematic approach to content delivery, partners default to selling what they know best rather than what might best serve their customers.

Most channel organizations fundamentally misunderstand the content problem. They invest heavily in producing high-quality assets but neglect the distribution and measurement systems necessary to ensure that content reaches partners at the right moment and drives intended business outcomes. The result is a costly content graveyard—valuable resources buried where partners rarely excavate them.

Content Creation Challenges in Channel Ecosystems

Content creation for channel ecosystems presents challenges that differ from typical marketing content production. While most marketing organizations have streamlined processes for creating customer-facing content, partner-focused content requires additional dimensions of complexity. Partners need not just product information but competitive battlecards, objection handling guidance, technical implementation details, and customer success stories that demonstrably prove value.

Organizations frequently duplicate efforts—creating similar assets multiple times for different audiences or failing to repurpose existing content for partner consumption. Traditional content systems also create insurmountable scalability barriers. As partner ecosystems grow, the diversity of partner types increases—from global systems integrators to specialized vertical market resellers. Each partner segment requires contextually relevant content that addresses their specific business models and customer bases. Without sophisticated content personalization capabilities, channel teams face an impossible choice between generic assets that serve everyone poorly or custom creations that don’t scale.

The Distribution Bottleneck

Even the most brilliantly created content delivers zero value if partners never engage with it. This simple truth highlights the importance of distribution mechanisms in the content lifecycle. Traditional notification approaches—typically mass emails announcing new assets—achieve dismal engagement rates, with most partner communications seeing open rates below 15% and click-through rates in the single digits. That isn’t to say emails shouldn’t be part of a greater distribution strategy, however.

These notification limitations create a persistent engagement paradox: partners consistently cite “better enablement content” as a top request from suppliers, while simultaneously failing to engage with the content those same suppliers have already produced. The disconnect lies not in content quality but in distribution methodology. Partners operating across multiple vendor relationships face a constant barrage of communications, creating notification fatigue that renders traditional alerts ineffective.

Content discovery presents equally troubling friction points. The average partner portal contains hundreds or thousands of assets organized according to internal supplier logic rather than partner workflows. Without intuitive navigation, advanced search capabilities, or personalized recommendations, partners typically abandon their search after viewing just three to five portal pages. Critical sales enablement materials often remain undiscovered precisely when partners need them most—during active customer engagements.

The financial implications of these distribution bottlenecks are substantial but frequently overlooked. When organizations measure content ROI solely through production costs rather than utilization metrics, they miss the true economic impact of distribution failures. A single high-value technical whitepaper might cost $10,000 to produce, but if only 5% of partners discover and utilize it, the effective cost per engagement skyrockets to $2,000 per partner—an indefensible investment by any standard.

Solving the content lifecycle dilemma requires more than incremental improvements to existing processes. It demands a fundamental rethinking of how content flows through partner ecosystems—from AI-assisted creation to intelligent distribution to closed-loop measurement. Organizations that master this lifecycle create self-reinforcing enablement engines that continuously optimize both content production and partner utilization.

ZiftONE’s AI-Powered Notification System

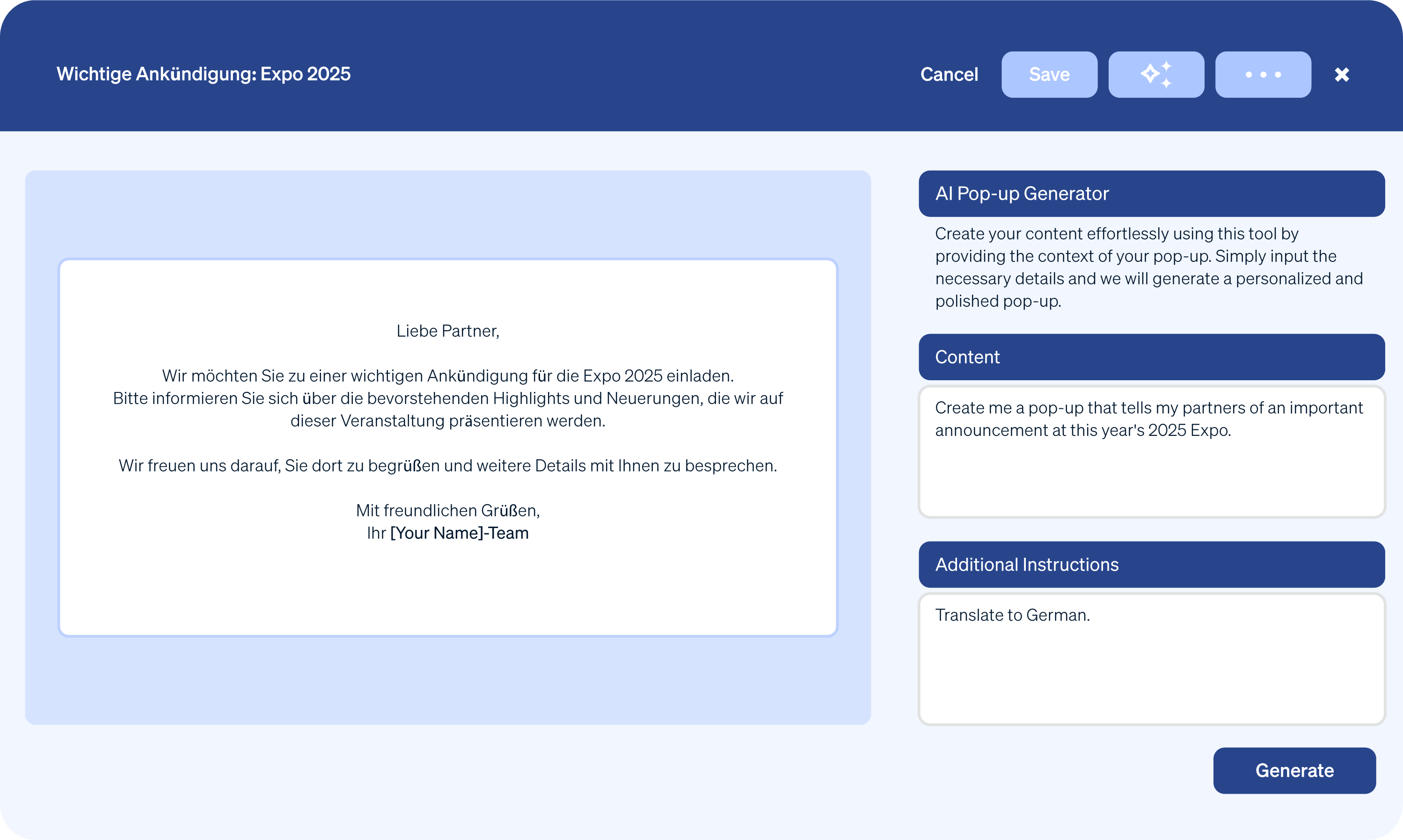

ZiftONE’s notification system with generative AI enables channel leaders to increase engagement without wasting time. Channel managers can now provide basic information about new content—target audience, key benefits, use cases—and AI systems draft notification text optimized for engagement and action. This capability is particularly valuable for technical content where communicating complex concepts in accessible language has traditionally been challenging. Suppliers should opt to alert partners about a new asset through at least 3 different channels to maximize engagement. When partners visit the partner portal, they may encounter a new asset for the first time at the critical moment they hit the page. Partner time is valuable and a single supplier must fight for a slice of that time. Notifications—while simple in concept—create instant awareness and a sense of urgency. Through email, pop-up notifications, and partner content feeds (such as through the ZiftONE integration with Unifyr+), suppliers stand to achieve rock-solid content reinforcement and high engagement rates.

Unifying the Partner Experience with Unifyr+

Unifyr+ addresses one of the most persistent pain points for partners: the fragmentation of information across dozens of supplier portals, each with unique interfaces, organization schemes, and access requirements. By consolidating content from multiple suppliers into a unified feed, these platforms enable partners to efficiently monitor and access new materials from across their entire supplier portfolio. This aggregation dramatically reduces the time partners spend searching for information and increases the likelihood they’ll discover valuable content that might otherwise be missed in the noise of multiple systems.

Streamlined partner operations deliver measurable productivity improvements that directly impact suppliers’ channel performance. When partners can access sales enablement materials from multiple vendors through a single interface, they spend significantly more time selling and less time navigating administrative barriers. This operational efficiency translates into more customer conversations, faster deal progression, and ultimately higher close rates. For suppliers, the key insight is that making their content available through aggregation platforms isn’t a competitive risk but rather a strategic advantage that increases partner engagement and mindshare.

Content discovery improvements within unified platforms leverage cross-supplier intelligence to surface the most relevant materials for specific selling situations. Advanced recommendation engines analyze content consumption patterns across the partner community to identify which materials are most helpful for particular industries, customer sizes, or use cases. This collaborative filtering approach helps partners discover high-value content that might remain buried in traditional single-supplier libraries, creating a network effect where content utilization improves as more partners and suppliers join the ecosystem.

This collaborative filtering approach helps partners discover high-value content that might remain buried in traditional single-supplier libraries, creating a network effect where content utilization improves as more partners and suppliers join the ecosystem.

The cross-supplier content experience creates interesting dynamics that forward-thinking channel teams can leverage. Partners naturally compare content quality, organization, and accessibility across their supplier portfolio, creating implicit competitive pressure to improve enablement materials. This transparency incentivizes suppliers to invest in higher-quality content, more intuitive organization, and better supporting context—improvements that ultimately benefit the entire channel ecosystem. Leading suppliers embrace this comparative environment as a catalyst for continuous improvement rather than resisting the inherent benchmarking that occurs when partners view multiple vendors’ content side-by-side.

Analytics and Revenue Attribution

Traditional PRM solutions have long suffered from a critical measurement gap—the inability to connect partner content engagement with actual revenue outcomes. This creates several persistent challenges for channel leaders: difficulty justifying content investment, inability to identify which enablement resources drive results, and limited insight into how content consumption patterns correlate with partner performance. Without closing this measurement loop, channel organizations engage in a perpetual guessing game about which content strategies deserve continued investment.

Content engagement serves as a powerful leading indicator of partner success when properly analyzed. Partners who consistently engage with enablement content typically outperform their peers by significant margins—often generating 30-40% more revenue than partners with similar certifications and market focus but lower content utilization. This correlation becomes even stronger when examining engagement with specific content types, particularly technical implementation guides and competitive battlecards.

The missing link in most channel ecosystems has been sophisticated attribution models that connect content consumption to revenue generation. Without such models, channel leaders struggle to answer fundamental questions: Which content resources are influencing deals? How does the timing of content access impact sales cycle progression? What is the actual ROI of our content investment? These questions aren’t merely academic—they directly inform resource allocation decisions worth millions in potential channel revenue.

Data-driven optimization of content strategy represents the ultimate goal of closed-loop analytics. When channel organizations can identify precisely which content types, formats, and distribution methods drive partner performance, they can shift resources toward high-impact enablement materials while refining or eliminating underperforming assets. This optimization creates a virtuous cycle where content investment generates increasingly higher returns through evidence-based refinement.

Identifying Content for Retirement

Performance-based retirement triggers offer the most objective foundation for content lifecycle decisions. Assets that show declining engagement metrics, reduced influence on deals, or negative partner feedback present clear candidates for retirement or refresh. Leading PRM solutions automate this identification through performance thresholds that flag underperforming content for review at regular intervals. This data-driven approach removes much of the subjectivity from retirement decisions and ensures that limited content management resources focus on the materials most in need of attention.

Age and relevance assessments provide complementary perspectives that catch retirement candidates performance metrics might miss. Systematic content dating and review policies—often implemented through metadata requirements and automated reminders—ensure that all materials receive periodic evaluation regardless of their usage patterns. These scheduled assessments are particularly important for specialized content that may see limited engagement due to its niche application rather than quality issues. Without these calendar-based review triggers, highly specialized but critical materials can remain in circulation long after they’ve become dangerously outdated.

Competitive positioning analysis represents another crucial retirement trigger as market dynamics evolve. Content that accurately represented competitive differentiation at creation may become misleading or ineffective as competitors release new offerings, adjust pricing strategies, or pivot their market approach. Regular competitive audits of key sales and marketing materials help identify content that no longer effectively positions the supplier’s solutions against current competitive realities. This analysis should extend beyond obvious comparison charts to examine how competitive context has shifted across all enablement materials.

Compliance and regulatory considerations introduce non-negotiable retirement requirements that override all other factors. Changes in data protection laws, product certification standards, export controls, or industry-specific regulations can instantly render previously approved materials non-compliant. Leading channel programs maintain close coordination between content teams and legal/compliance functions to ensure rapid identification and retirement of affected assets. Some advanced PRM platforms now incorporate compliance monitoring features that automatically flag content containing specific terms or claims for review when relevant regulations change.

The Future of Channel Content Management

As we look toward the horizon of channel partnership management, several emerging technologies promise to change how organizations create, distribute, and measure partner enablement content. These advancements extend far beyond incremental improvements to existing processes—they represent paradigm shifts in how channel ecosystems function and the value they deliverto all participants.

Artificial intelligence stands at the forefront of this transformation, with capabilities that surpass simple automation. Advanced machine learning models now analyze partner behavior patterns to identify subtle correlations between content engagement and business outcomes. These systems continuously refine their understanding of which resources most effectively enable different partner types at various stages of their development journey. The result is a predictive enablement engine that can identify precisely which content interventions will most likely improve specific partner performance metrics.

Predictive partner enablement represents the natural evolution of these AI capabilities. Rather than reactively responding to partner requests or broadly distributing content based on general categorization, predictive systems proactively identify enablement gaps in individual partner organizations. They then automatically recommend or even directly provide the specific resources most likely to address those gaps—often before partners themselves recognize their needs. This shift from reactive to predictive enablement dramatically improves resource utilization while accelerating partner performance development. For more information on the lead and deal predictive capabilities of ZiftONE, read our blog here.

AI-driven personalization at scale fundamentally resolves the longstanding tension between customization and scalability in partner enablement. Traditional approaches forced an uncomfortable choice: provide generic content to all partners (sacrificing relevance) or create custom materials for each partner (prohibitively expensive). Advanced AI systems eliminate this dilemma by dynamically adapting content based on partner profile, historical engagement, current opportunities, and even market conditions—all without human intervention. This enables true 1<1> personalization across thousands of partners without corresponding increases in content creation costs.